During my first year at The Darden Graduate School of Business at the University of Virginia, the class I struggled with most wasn’t Finance or Quantitative Analysis. To my surprise, it was Marketing.

I understood the Four Ps—Product, Price, Place, Promotion—and could breeze through contribution margin formulas. But the cases puzzled me. Why were we trying to sell things—odor-resistant socks, contact lenses for chickens—to people who didn’t really need or want them?

The shift happened during the first semester of my second year, in a class built around the Markstrat simulation. That’s when everything started to make sense.

Markstrat is a strategy game where you manage a fictional company in a simulated competitive market. Each team makes decisions about product development, pricing, marketing spend, and—most importantly—market research. It quickly became clear that success didn’t come from pushing more of the same product. It came from understanding what customers wanted but weren’t getting, and then developing offerings to meet that unmet need—finding the gaps in the market.

While many teams simply extrapolated what had worked before, our team focused on identifying underserved segments. We adjusted product specs and introduced offerings tailored to those needs. The result? We weren’t the biggest, but we had the fastest-growing market share and the highest increase in stock value.

That experience taught me that strategy isn’t about copying what worked last year. It’s about anticipating what will matter next. That same mindset has guided my approach to community development ever since.

Start With the Economics—What Investors and Lenders Expect

Before you can talk about vision, lifestyle alignment, or brand identity, you need to speak to your stakeholders in the language they trust: hard data.

When preparing a community for internal greenlighting or external capital, the market research needs to be more than a formality—it must serve as a robust, defensible foundation for decision-making.

Here’s what banks, equity investors, and institutional partners expect in a well-structured market study:

- Executive Summary

Clear headline findings and a Go/No-Go recommendation to convey the core thesis at a glance. - Project Overview

Site description, acreage, land use mix, and phasing strategy to set the stage and contextualize the opportunity. - Demographic and Economic Trends

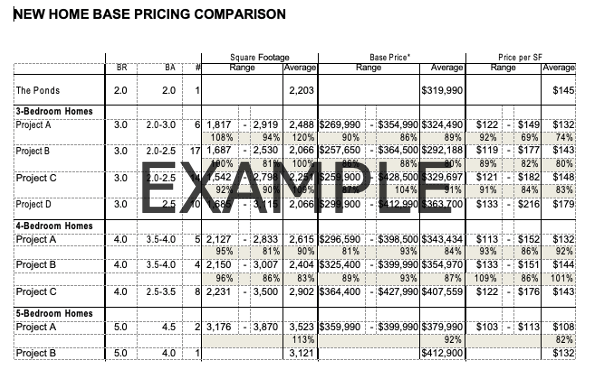

Data on population growth, household formation, income distribution, job trends, and regional infrastructure to ground the demand forecast. - Competitive and Supply Landscape

A breakdown of current and upcoming projects—who’s delivering what, at what pace, and at which price points. - Demand Analysis by Use Type

Forecasts for residential (by product and price band), retail, office, and hospitality—by household type, income qualification, tenure preferences, and psychographic alignment. - Revenue and Pricing Assumptions

Justifications for sale prices, lease rates, and rental benchmarks used to test your pro forma. - Absorption and Phasing Strategy

Recommended unit releases by phase, expected absorption timelines, and velocity assumptions. - Opportunity and Gap Analysis

Identification of unmet or underserved demand—by lifestyle, household type, or product format. - Risk and Sensitivity Assessment

Downside scenarios for pricing, absorption, and timing to help de-risk capital deployment. - Appendices

Data tables, comps, GIS mapping, psychographic profiles, and methodology to support the findings.

Finding the Gaps: Designing for the People the Market Overlooks

One of the biggest mistakes I see in development today is assuming that everyone fits a standard profile: a household of 3.15 people, seeking a 2,140-square-foot home with 2.8 bedrooms and a two-car garage. That—and “steering by the wake”—assumes what sold yesterday will work tomorrow.

This results in communities that feel like watered-down versions of the past. People end up settling for what they dislike the least, instead of choosing what they love most.

“If you always do what you’ve always done, you’ll always get what you’ve always got.”

—Henry Ford

That’s not real life. And it’s certainly not the full market.

When we look more closely, we find an abundance of underserved households: single professionals, multigenerational families, aging boomers seeking walkability without maintenance, child-free couples, remote workers, and creatives craving live/work flexibility. These groups aren’t fringe. They’re just not being served well by most new developments

That’s where deeper, forward-facing research comes in—not just to validate a plan, but to shape it.

From Data to Insight: Diana and the Art of Positioning

At Celebration, I’On, Nexton, and Summers Corner, we worked closely with Diana Permar and her team—one of those rare group of market research professionals who not only know how to gather market intelligence, but how to translate it into strategy.

Diana doesn’t just identify trends—she helps define how a project can authentically and profitably respond to them. Together, we used lifestyle segmentation data, demographic modeling, and qualitative insight to shape communities that moved beyond conventional suburbia.

We saw growing demand for walkability, flexible housing formats, and wellness-oriented environments—and designed street grids, commercial mixes, and branding strategies accordingly.

Diana’s work reminded us that great positioning isn’t about following trends—it’s about anticipating desire.

Avoiding Commodification Through Psychographic Insight

This brings us to psychographics.

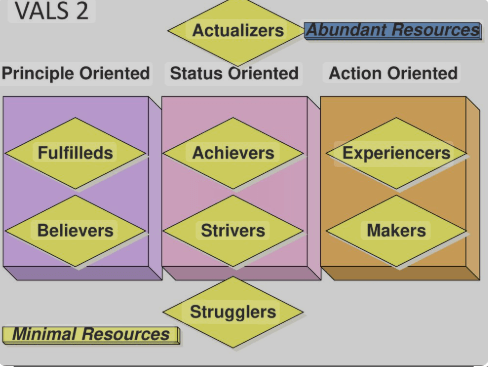

Demographics tell us who people are—age, income, education. Psychographics tell us why they make the choices they do—what they value, how they define success, and what “home” feels like

That’s why we’ve used the VALS2 framework, which categorizes people by motivations (ideals, achievement, self-expression) and access to resources, to align design decisions with future residents’ psychology.

A few examples:

- Innovators seek sophistication and uniqueness. They’re drawn to bold architecture, cultural edge, and exclusive experiences.

- Achievers want structure, prestige, and predictability—favoring gated entries, premium branding, and consistent services.

- Experiencers crave variety, connection, and creative energy. They’re attracted to mixed-use neighborhoods, live/work spaces, and public art.

- Makers value utility, craftsmanship, and independence. They respond to practical layouts, DIY amenities, and hands-on environments.

As Simon Sinek says “People don’t buy what you do; they buy why you do it.” Aligning your “Why’ with potential future resident’s “Why’s” just make good business sense.

Integrating these insights early—during the Strategic Definition Phase—helps ensure we design places that resonate deeply, not just sell quickly.

Celebration, I’On, Bundoran Farm: Purposeful Differentiation

Projects like Celebration, I’On, and Bundoran Farm didn’t succeed just because they were attractive or well-capitalized. They worked because they were differentiated—rooted in real research and designed to serve unmet needs.

At Celebration, we used tools like VALS2 not only to shape housing but also governance, communication, and programming. The result was a human-scaled, cohesive community.

At I’On, we abandoned the suburban template in favor of walkable streets, civic spaces, and Lowcountry-inspired architecture—crafted not for the median buyer, but for those seeking a more connected lifestyle.

At Bundoran Farm, research identified a high-value segment seeking land, privacy, and authenticity—without the isolation of typical large-lot development. So we delivered estate homes within a working farm, with the landscape preserved as a shared amenity.

Each of these communities aligned economics with identity. They weren’t just viable—they were emotionally resonant.

Final Thought: Listen Forward

Too many developments today are shaped by what worked yesterday. They build for the average, ignore the overlooked, and blend into sameness.

But when you combine rigorous economic data with meaningful human insight—when you use market research not just to confirm assumptions but to guide bold decisions—you create more than homes.

You create belonging.

That kind of community doesn’t just fill up.

It flourishes.

It retains value.

It earns loyalty.

It becomes a place people talk about.

So let’s stop steering by the wake.

Let’s start listening forward.

Because the future of real estate isn’t about replicating what sold—

It’s about discovering what’s missing and building what matters.

Leave a comment